If you live and work in Mexico, you may need to generate a factura (electronic invoice) for the products or services you provide. Facturas are essential for tax reporting and business transactions. Some clients may require the factura before they pay you, and others are fine to receive it after payment. It’s important to ask up-front. After living here for over a year, I’m sharing this guide to help others do what I’ve had to learn over time. This reflects the February 2025 redesign of the SAT site.

You’re welcome and you can reward me in beverages if you see me around town!

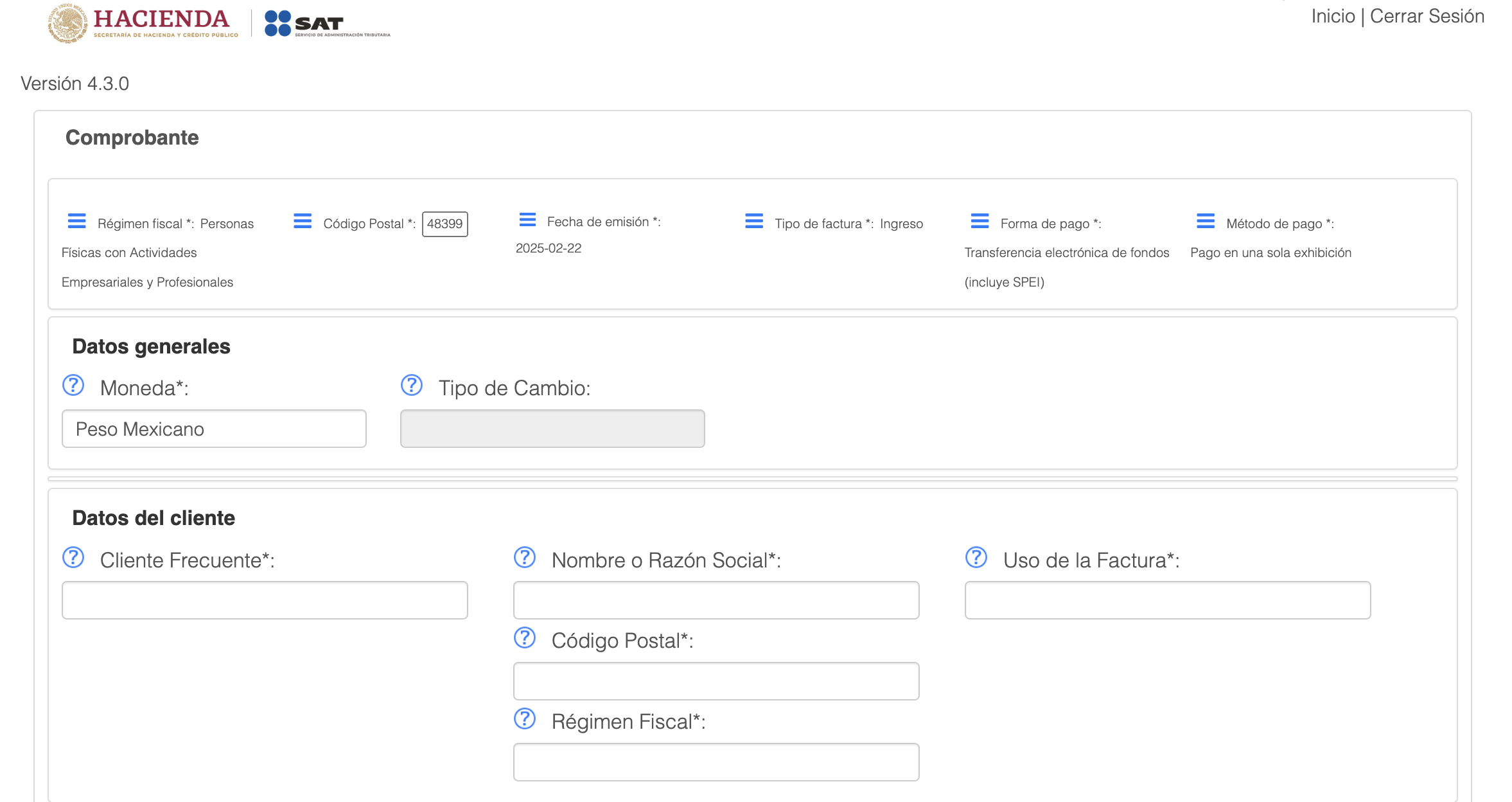

Below, I walk you through the step-by-step process of creating a factura through Mexico’s official tax authority, the SAT (Servicio de Administración Tributaria).

However, this guide is for informational purposes only, and you should consult an experienced accountant to ensure compliance with your specific tax regime. You can also have your accountant do these for you!

Step 1: Accessing the SAT Portal

Visit the official SAT website: https://www.sat.gob.mx/portal/public/home

Step 2: Navigating to the Factura Section

- Select Trámites y Servicios (Procedures and Services).

- Click on Factura Electrónica (Electronic Invoice).

- Choose Genera tu Factura (Generate Your Invoice).

- Click Servicios de facturación de CFDI (CFDI Billing Services).

- Select Servicio gratuito de facturación (Free Billing Service).

Step 3: Logging into Your SAT Account

- Enter your RFC (Registro Federal de Contribuyentes).

- Input your Contraseña (password).

- Complete the Captcha verification.

- Click Enviar (Submit).

Step 4: Entering Client Information

- If it is a repeat client, select Cliente Frecuente and pick your clients RFC number from the drop-down options. If new, enter it here.

- Enter your Código Postal (ZIP Code)

- Select the Régimen Fiscal (Tax Regime). This is based on your tax obligations, such as General de ley personas morales (General Corporate Regime) or another, as your accountant advises.

- Click Agregar (Add).

Step 5: Entering Product or Service Information

- Provide a Descripción Detallada (Detailed Description) of the service or product. (This must be in Spanish, and you can’t copy and paste, so keep a separate document to refer to if needed.) (Ask your accountant.)

- Select the Producto o Servicio code that corresponds to your work. For example, there are different codes, such as 80141600, for commissions or professional fees. (Ask your accountant.)

- Enter the Valor Unitario (Unit Price) in pesos.

- Select Objeto de Impuesto such as Sí objeto de impuesto (Taxable). (Ask your accountant.)

Step 6: Configuring Tax Details

Consult your accountant to determine the correct tax percentages for your invoice. However, general values may include:

- Uncheck the box Acepto Sugerencia de Impuestos (I Accept Suggested Taxes) if you want to enter a personalized percentage beyond the 16% IVA—as advised by your accountant.

- Enter IVA cobrado (Value-Added Tax collected) at 16% Valor

- Enter Retención de IVA (Withholding VAT) at 10.6667% Valor

- Enter Retención de ISR (Income Tax Withholding) at 1.25% Valor

Step 7: Reviewing and Finalizing the Factura

- Click Guardar (Save).

- Carefully review the details under Producto y Servicio before proceeding. It’s the small print, so get out your glasses!

- Click Sellar (Seal).

Step 8: Confirming Your Credentials

- Enter your password again.

- Attach your e-firma (electronic signature) files:

- Clave (Key)

- Tomo (Volume)

- Click Confirm.

- Click Sellar (Seal).

Step 9: Downloading and Renaming the Factura

The system will generate a file that should automatically download to your hard drive as a zip file.

- Download the PDF version.

- Email or WhatsApp the PDF to your client for their records.

- For your records, you can rename the file using a clear format, for example, Client Name_Property Name_Date.pdf

Final Thoughts

Generating a factura in Mexico is essential for business owners, contractors/freelancers, and service providers. It’s also important to note that the SAT website is used nationwide, and like many things in Mexico, it moves slowly or not at all on some days. Try different browsers, times of day, or days of the week when the traffic is less intense. Don’t give up! You can do this.

While this guide outlines the general steps— each individual’s tax situation may vary. Always consult an experienced accountant to ensure compliance with SAT requirements and properly classify your invoice details, or opt to have them do it for you!

By following this guide and seeking professional tax advice, you can confidently issue facturas and stay compliant with Mexico’s tax regulations.

Next step… you have to pay monthly personal taxes at your bank. More on that soon.